Don’t Let Inflation Steal Your Wealth: What ₹1,00,000 Today Means for PSU Professionals in 10 Years

Inflation is an economic phenomenon that affects everyone, especially when planning for future financial goals.

For working professionals in India, understanding the implications of inflation on your savings and investments is crucial for realistic financial planning.

This article will illustrate how inflation impacts your financial goals by projecting what ₹1,00,000 today might cost in 10 years, using examples relevant to everyday life in India.

Understanding Inflation

Inflation refers to the general increase in prices and fall in the purchasing value of money over time.

In simpler terms, as prices rise due to inflation, the amount of goods or services you can buy with a fixed sum of money decreases.

This can significantly impact various aspects of life, from daily expenses to long-term financial goals.

The Current Scenario

As of recent years, India has experienced varying rates of inflation. The Reserve Bank of India (RBI) aims to maintain inflation around 4%, but it can fluctuate based on economic conditions.

To understand how this impacts your financial planning, let’s look at some real-life examples.

Projecting Costs: ₹1,00,000 Today vs. 10 Years Later

Assuming an average annual inflation rate of 6% (which can be typical in India), let’s calculate how much ₹1,00,000 today will be worth in 10 years:

Future Value Calculation

Using the formula for future value:

FV = PV * (1 + r)^n

Where:

- FV = Future Value

- PV = Present Value (₹1,00,000)

- r = annual inflation rate (0.06)

- n = number of years (10)

Calculating this:

FV = ₹1,00,000 * (1 + 0.06)^{10} = Approx ₹1,79,085 ]

So, ₹1,00,000 today would cost approximately ₹1,79,085 in 10 years, assuming a consistent inflation rate of 6%. Now let’s see how this affects various financial goals:

Real-Life Examples of Inflation Impact

1. Cost of Education

Consider the rising costs associated with higher education in India:

- Current Tuition Fees: A prestigious engineering college might charge about ₹2,00,000 per year.

- Projected Cost in 10 Years: If we assume an annual inflation rate of 8% for education costs:

FV = ₹2,00,000 * (1 + 0.08)^{10} 589 = Approx ₹4,31,780

Thus, what costs ₹2 lakhs today could potentially cost around ₹4.3 lakhs in 10 years!

2. Housing Costs

The real estate market in India is another area heavily impacted by inflation:

- Current Home Prices: A modest apartment may cost around ₹50 lakhs today.

- Projected Price in 10 Years: With a conservative estimate of annual property price inflation at 5%:

FV = ₹50,00,000 * (1 + 0.05)^{10} 9 = Approx ₹81,44,450

In this case, that home could cost approximately ₹81.4 lakhs in just a decade.

3. Healthcare Expenses

Healthcare costs are consistently rising and are a significant concern for future planning:

- Current Medical Insurance Premiums: Let’s say a premium is currently ₹20,000 annually.

- Projected Premium in 10 Years: Assuming healthcare costs inflate at about 7% per year:

FV = ₹20,000 \times (1 + 0.07)^{10} = Approx ₹39,343

So what you pay today could grow to about ₹39,343 in just ten years.

In an ever-changing economic landscape, inflation can be a silent killer of financial stability.

For employees like is in Public Sector Undertakings (PSUs), a solid savings amount today may not be enough to secure a comfortable future.

so i wish to go even further and explore for you at least 10 more shocking ways inflation can erode your ₹1,00,000 savings, serving as a crucial wake-up call for every PSU employee.

1. Rising Cost of Living: The Daily Drain

Imagine your current monthly expenses tally up to ₹30,000. With an average inflation rate of 6%, those same expenses could inflate to nearly ₹53,000 in just 10 years!

If your savings sit idle and fail to earn returns that outpace inflation, you'll find that your ₹1,00,000 won't last nearly as long as you anticipated.

2. Education Expenses: From ₹2 Lakhs to Over ₹4 Lakhs

For PSU employees planning for their children’s education, the shock is even greater.

Today’s engineering degree costing around ₹2 lakhs may skyrocket to approximately ₹4.3 lakhs in ten years due to an annual inflation rate of 8%.

If your savings are not growing at a similar pace, you’ll be caught off-guard when it comes time for tuition payments!

3. Housing Market: Property Prices on the Rise

If you’re hoping to buy a home currently priced at ₹50 lakhs, brace yourself—after ten years of a 5% annual inflation rate, that same property could cost around ₹81.4 lakhs!

What does this mean for your savings?

Without strategic planning and investment growth, your current ₹1 lakh savings will barely scratch the surface of a down payment.

4. Healthcare Costs: From ₹20,000 to Nearly ₹40,000

Healthcare is another area where inflation hits hard. Current medical insurance premiums may be around ₹20,000 annually; in just a decade, they could rise to nearly ₹39,343!

Are your savings ready to handle this nearly double expense?

The pain of inadequate healthcare coverage could lead to financial stress in times of need.

5. Vehicle Purchase Prices: From ₹8 Lakhs to ₹12 Lakhs

If you’re eyeing a car priced at ₹8 lakhs today, don’t be surprised if that same vehicle costs about ₹12 lakhs in ten years due to a typical 5% inflation rate on automobile prices.

Inflation doesn't just impact the market—it directly affects your ability to afford basic necessities like transportation.

6. Inflation-Adjusted Savings: The False Security

Having ₹1 lakh in savings may seem substantial now; however, if that money isn't growing with inflation, its real value diminishes over time.

If you keep it in a standard savings account earning a mere 3% interest while inflation runs at 6%, you're effectively losing purchasing power every year!Your nest egg is losing value right before your eyes—it's not just about the amount; it’s about what it can buy.

7. Emergencies and Unforeseen Costs

Emergencies can strike at any moment. A health issue or urgent home repair might require immediate funds—yet the cost for services can inflate dramatically.

What you thought would cost ₹20,000 today could easily double due to rising prices in the coming years!

The lack of adequate savings can lead to dire financial straits when unexpected expenses arise.

8. Retirement Planning: From Comfort to Compromise

If you plan for retirement based on today's costs without adjusting for inflation, you risk compromising on your lifestyle later on.

If your monthly retirement expenses are projected at ₹30,000 today, they'll inflate to about ₹53,200 in ten years!

Without sufficient growth in your retirement corpus—particularly one that accounts for inflation—you're setting yourself up for discomfort during your golden years.

9. Entertainment Expenses: The Price of Leisure

With entertainment costs rising alongside other goods and services—say from a monthly budget of ₹3,000 today to around ₹5,600 in ten years—you’ll find that even simple pleasures become burdensome if left unchecked by planning!

Being mindful of these rises is critical; overspending on leisure can quickly erode savings intended for more vital expenses.

10. Inadequate Emergency Funds: A Recipe for Financial Stress

Assuming you set aside ₹1 lakh as an emergency fund without considering inflation means its buying power will decrease over time. A few years from now, that fund may barely cover basic emergencies; rather than providing comfort and security, it becomes a source of anxiety instead.

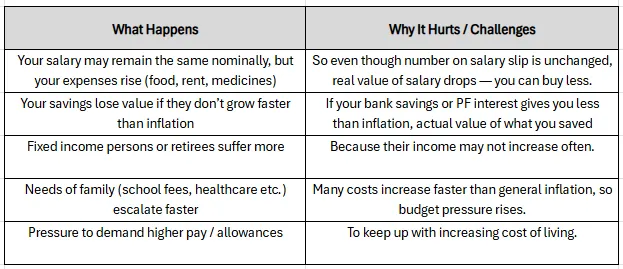

Effects of Inflation on Salaries / Your Life

Conclusion

Inflation isn’t just a number—it’s a living force that slowly erodes the value of your savings and impacts your financial security as a PSU employee.

When you don’t plan for inflation, your goals—education, housing, healthcare—can cost much, much more than you imagine.

For example:

- The inflation rate for general goods and services in India is currently around 2.07% (CPI year-on-year for August 2025).

- But in education, inflation is higher—around 3.60% for August 2025.

So, if something costs ₹ 2,00,000 today for education, in 10-15 years it may cost ₹ 4,30,000 or more, depending on how fast inflation goes.

Likewise, a house costing ₹ 50,00,000 today might jump to ~₹ 81,00,000 or more, if inflation isn’t accounted for.

These aren’t just numbers—they represent real cost shocks that affect real lives.

What You Can Do

To protect yourself:

- Increase your savings rate each year (or with each raise) so that your savings don’t lose value.

- Choose investment options that tend to beat inflation—e.g. equities, mutual funds, some government schemes etc.

- Revisit your financial goals at least once a year: check whether the cost estimates you made are still realistic in light of current inflation.

- Adjust your budget: see where recurring expenses are rising (food, fuel, rent, school fees) and plan ahead.

Why This Matters, Especially for PSU Professionals

- PSU jobs often provide some allowances & periodic increases (like DA) which help—but often these don’t fully match inflation in specialized expenses (education, private school fees, medical).

- If you ignore inflation, over time the “take-away value” of your salary, savings, and even pension could decline.

- Planning with inflation ensures you don’t get caught unprepared—so you can meet your goals comfortably, instead of struggling later.

Final Thought

Stay alert. Be proactive. Inflation is not something you can wait out—you must plan for it.

By being aware of inflation’s impact, updating goals, increasing savings, and investing smartly, you power yourself to not just survive changing costs, but to thrive despite them.

For more tips, advice and tools to handle inflation + smart financial planning, keep reading PsuPedia.com!