Insurance Planning for PSU Employees: Complete Guide to Life & Health Insurance

A complete insurance planning guide for PSU employees covering life insurance, term insurance, health insurance, and smart financial protection strategies.

Insurance Planning for PSU Employees: Why It Matters Today

For every PSU employee, job security and stable income are big advantages — but true financial security doesn’t come from salary alone.

It comes from planning for emergencies, protecting your loved ones, and preparing for medical uncertainties.

Insurance planning is not just a financial requirement…

It is a responsibility toward your family and future.

In this blog, we explain why life insurance + health insurance are essential for PSU employees, how much coverage is needed, and how to choose the right plans.

🔵 SECTION 1: Importance of Life Insurance for PSU Employees

Life insurance acts as a financial shield for your family in case of unexpected events.

A stable government or PSU job does not eliminate risks — accidents, illnesses, and uncertainties can happen to anyone.

⭐ Why PSU employees must take life insurance:

1️⃣ Protect Your Family Financially

If something happens to the earning member, life insurance ensures your family continues to live with dignity.

It covers:

- Children’s education

- Household expenses

- Loans & outstanding liabilities

- Long-term financial needs

Without life insurance, your family may face severe financial stress.

2️⃣ Term Insurance Is the Smartest

Choice

Most PSU employees still buy traditional plans (endowment, money-back, LIC conventional plans).

These give low returns and low insurance coverage.

Term insurance, on the other hand:

- Gives highest coverage

- At lowest premium

- No unnecessary investment components

- Pure protection for your family

It is the most cost-efficient and financially wise option.

3️⃣ How Much Coverage Should a PSU Employee Take?

Financial planners recommend:

✔ Coverage = 10–15× Annual Income

Example: If your salary is ₹8,00,000 per year

→ Ideal coverage = ₹80 lakhs to ₹1.2 crore

This ensures that your family can maintain their lifestyle even without your income.

🔵 SECTION 2: Health Insurance — Why It’s Important Even for PSU Employees

Many PSU employees assume:

But employer-provided insurance is often limited and may not cover:

- Entire family

- Large hospital bills

- Critical illnesses

- Post-retirement medical costs

Medical expenses in India are rising 10–14% every year.

A single hospitalization can cost ₹2–5 lakh or more.

Health insurance protects your savings from being wiped out.

⭐ Why Health Insurance Is Essential

1️⃣ Medical Costs Are Rising Rapidly

Even a simple surgery can cost thousands to lakhs.

Without health insurance, PSU employees are forced to use savings or borrow money.

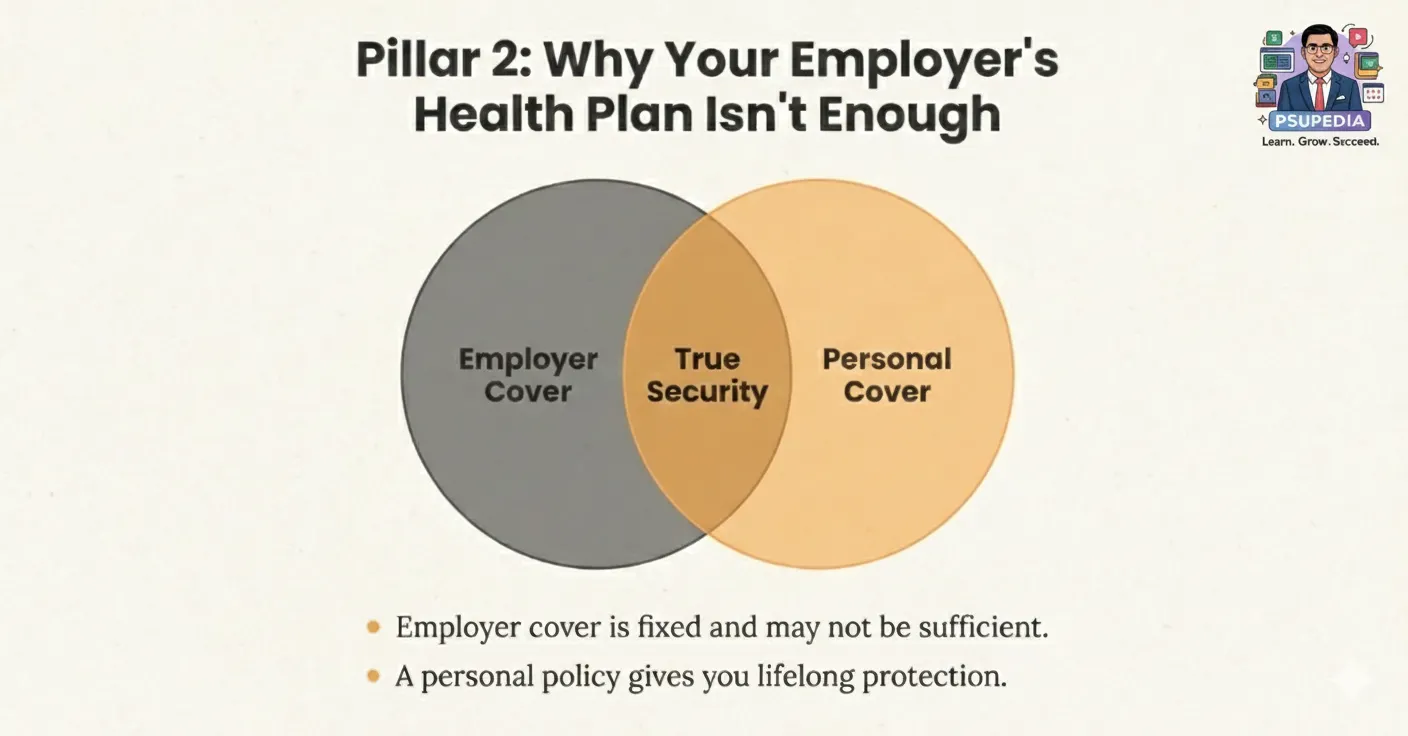

2️⃣ Employer Insurance Is Not Enough

It often includes:

- Low coverage limits

- Limited family protection

- No post-retirement coverage

Once you retire, PSU support reduces — but medical needs increase.

3️⃣ Buy a Personal + Family Floater Plan

A personal health insurance plan protects YOU.

A family floater plan protects your SPOUSE and CHILDREN.

Ideal coverage:

✔ Minimum ₹10–15 lakh health coverage

✔ Add critical illness rider if possible

🔵 SECTION 3: Insurance Checklist for PSU Employees

Area What You Should Do

Life Insurance Buy term insurance only

Coverage Amount 10–15× annual income

Health Insurance Buy personal + family floater

Employer Coverage Treat as secondary backup

Critical Illness Optional but recommended

Start Early Premiums are cheaper when younger

🔵 SECTION 4: Final Thoughts

Insurance planning is the foundation of a strong financial life for PSU employees.

It protects your family, shields your savings, and ensures peace of mind.

👉 Life Insurance = Protect your family’s future

👉 Health Insurance = Protect your financial stability

Start today — because uncertainties don’t wait.

🔗 Stay Connected With PSUPEDIA

👉 For more useful tips and short educational videos, follow us and visit our website:

📌 Join our Facebook Page for daily PSU education updates:

🔗 https://www.facebook.com/psupedia