Liquidity Trap Explained: Why Low Interest Rates Fail – A Guide for PSU Employees

In economic theory, lowering interest rates is one of the most powerful tools used by central banks to boost spending and investment.

The idea is simple: when borrowing becomes cheaper, people and businesses will spend more, invest more, and help the economy grow.

However, there are situations where this strategy completely fails.

Even when interest rates fall close to zero, the economy remains slow. This phenomenon is known as a Liquidity Trap.

This blog explains the concept of Liquidity Trap in a simple way,

especially for PSU employees, so that you can better understand macroeconomic policies and their real-life impact.

What Is a Liquidity Trap?

A Liquidity Trap occurs when:

- Interest rates are already very low

- Central banks inject more money into the economy

- But people and businesses still refuse to spend or invest

Instead of circulating money, everyone prefers to hold cash due to fear and uncertainty about the future.

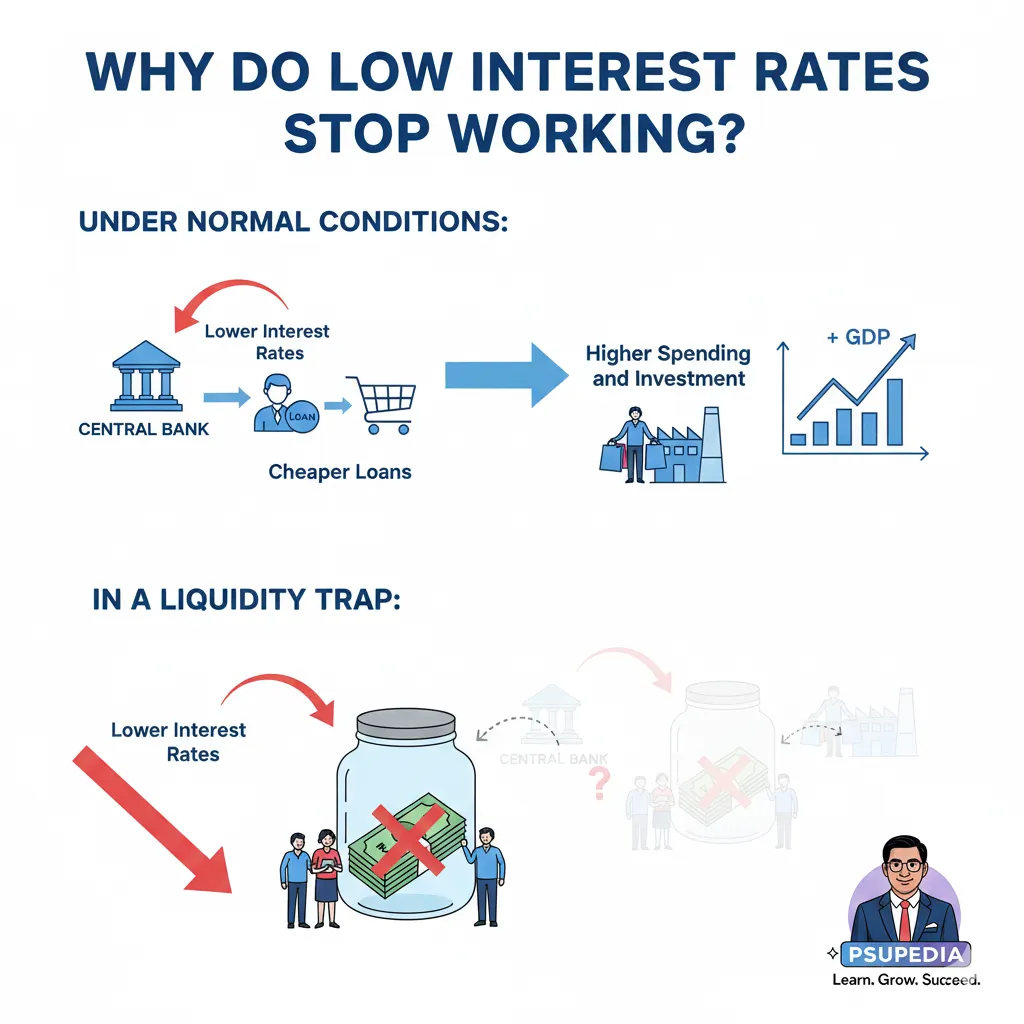

Why Do Low Interest Rates Stop Working?

Under normal conditions:

- Lower interest rates → cheaper loans

- Cheaper loans → higher spending and investment

But during a liquidity trap:

- People fear job loss or income instability

- Businesses expect low demand and poor profits

- Investors wait for “better times”

As a result, money stays locked in bank accounts instead of flowing through the economy.

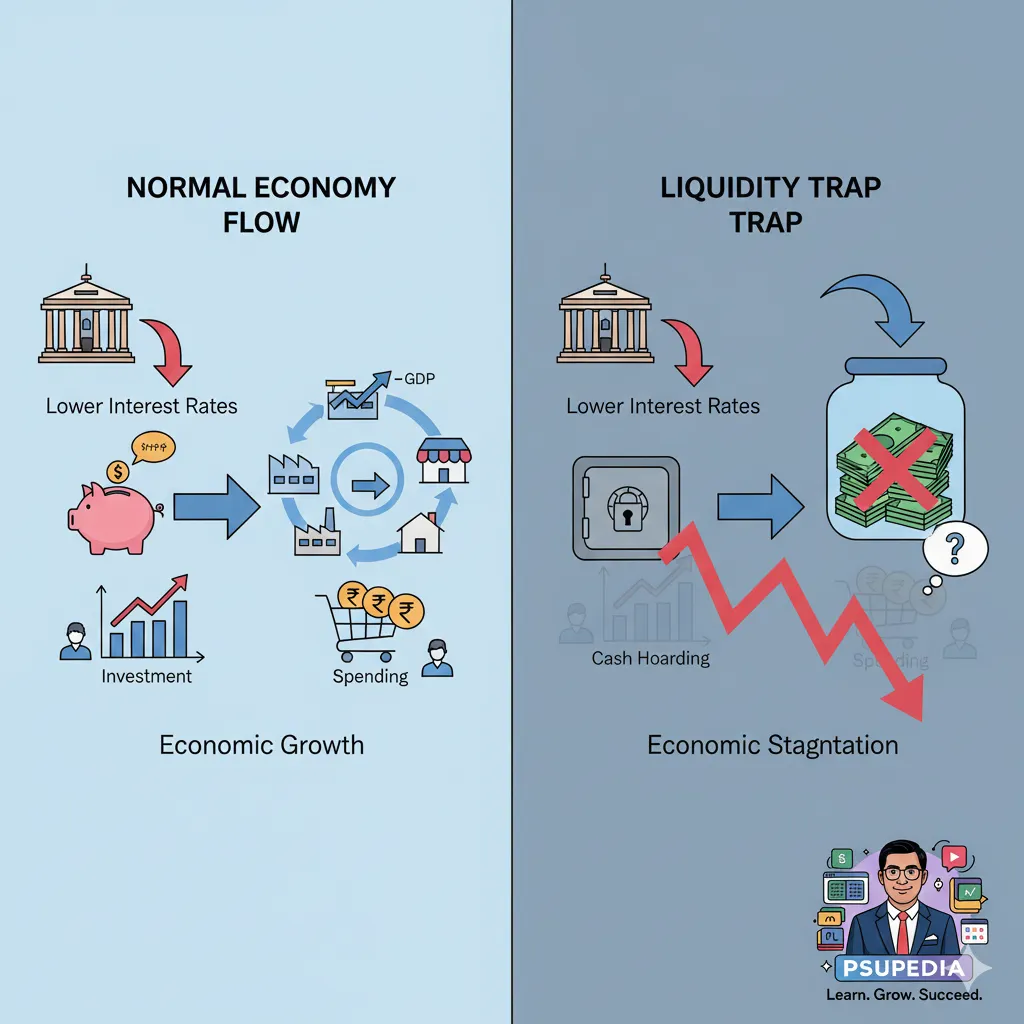

Role of People and Businesses

In a liquidity trap:

- Consumers save more and spend less

- Businesses delay expansion plans

- Investors avoid risky investments

This behavior creates a cycle where demand remains weak, forcing the economy to stay stagnant despite policy support.

Why Is Liquidity Trap Dangerous?

Liquidity traps are dangerous because:

- Traditional monetary policy becomes ineffective

- Economic recovery becomes slow and painful

- Risk of deflation increases

- Governments are forced to use heavy fiscal spending

For countries with large populations and employment dependence—like India—this situation requires careful policy coordination.

Why PSU Employees Should Understand This Concept

For PSU employees, understanding liquidity trap is important because:

- It explains government and RBI policy decisions

- It affects inflation, interest rates, and job security

- It improves financial decision-making and awareness

Economic literacy helps PSU professionals stay informed and prepared during uncertain economic phases.

Key Takeaway

✔ Low interest rates alone cannot revive an economy

✔ Confidence and demand are equally important

✔ Liquidity trap shows the limits of monetary policy

Understanding such concepts helps PSU employees connect macroeconomic theory with real-world outcomes.

Conclusion

A liquidity trap is a reminder that economic recovery is not just about money supply

—it’s about trust, confidence, and expectations.

For PSU employees, staying informed about such concepts is essential for smart financial planning and professional growth.

👉 For more simple finance explainers made for PSU employees, follow PSU PEDIA and visit:

📌 Subscribe to our YouTube channel & facebook for regular educational content:

🔗 https://youtube.com/@psupedia?si=HgkyHBAafuaYzVx8