PSU Employees: How to Decide Your Risk Profile Correctly

For PSU employees, job stability, regular income, and long-term benefits provide a strong sense of financial comfort.

This stability is a major advantage. However, when it comes to investing, one important question often creates confusion:

How much risk is actually right for a PSU employee?

This article explains why taking zero risk is not always safe, why taking high risk without understanding is dangerous, and how PSU employees can identify their right risk profile with clarity and confidence.

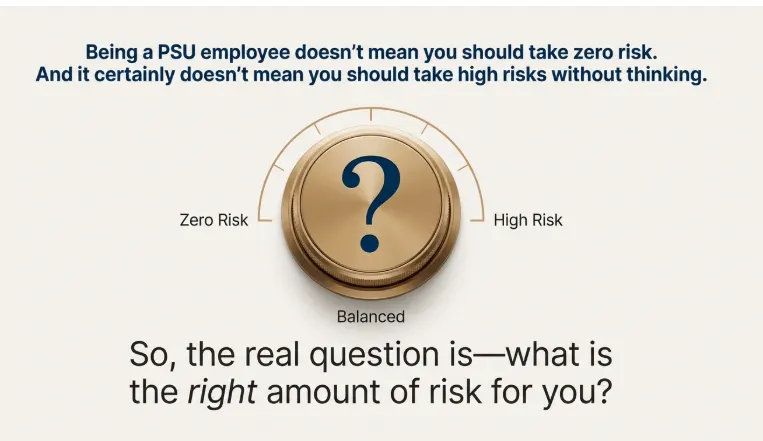

Zero Risk and High Risk: Both Are Extremes

Many PSU employees fall into one of two extremes:

- Some believe they should take zero risk and keep all their money only in PF, FD, or savings.

- Others enter the market without proper understanding, assuming that higher risk will automatically lead to higher returns.

In reality, both approaches are risky.

The correct question is not:

“Should I take risk or not?”

The correct question is:

“For my personal situation, how much risk is appropriate?”

What Does Risk Profile Mean?

A risk profile is your ability to handle uncertainty.

This ability is not limited to money alone. It also depends on:

- Your emotional response to market ups and downs

- Your practical life situation and responsibilities

Risk is not only about market fluctuations.

It is closely connected to your personal circumstances.

That is why every PSU employee has a unique risk profile.

Three Key Factors That Decide Risk Profile

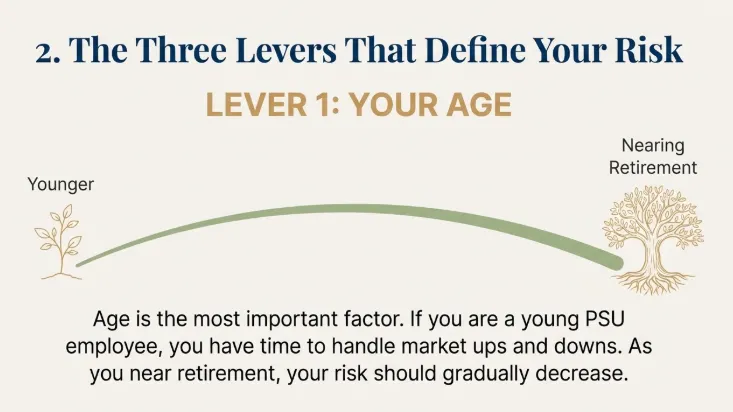

1️⃣ Age

Age is one of the most important factors.

- Younger PSU employees have time on their side.

- Time allows investments to recover from short-term volatility.

- As retirement approaches, it becomes sensible to gradually reduce risk.

Time acts as a safety cushion. Less time means lower recovery capacity.

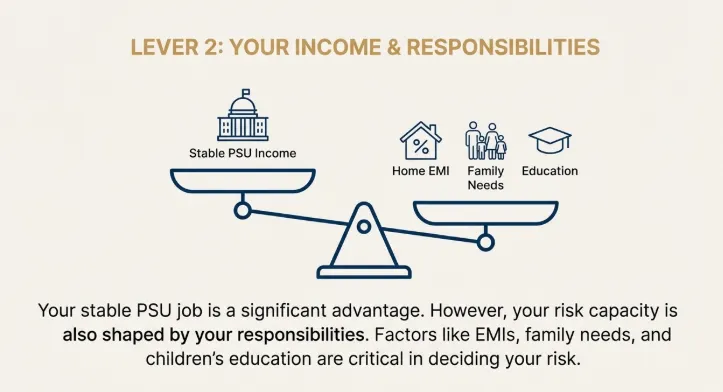

2️⃣ Income and Job Security

PSU jobs are stable, and this stability is a major advantage.

However, income alone does not decide risk capacity.

Other responsibilities also matter:

- Family obligations

- EMIs and loans

- Children’s education and future needs

All these factors together determine how much risk can be taken comfortably.

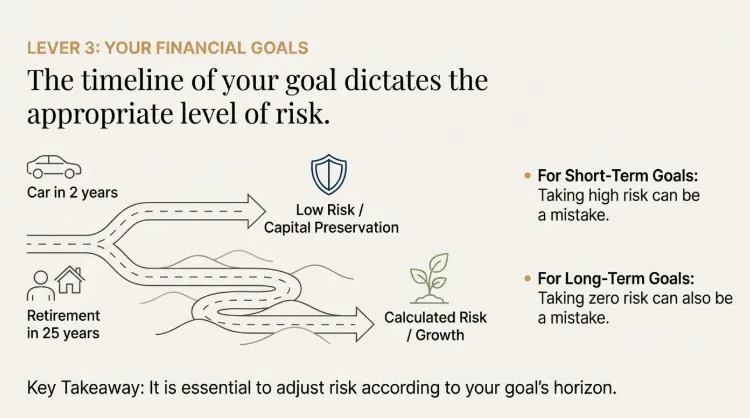

3️⃣ Financial Goals

Risk should always be aligned with financial goals.

- Short-term goals should avoid high risk.

- Long-term goals, such as retirement, should not remain in zero-risk instruments.

Mismatch between goals and risk level can damage long-term planning.

Common Mistakes Made by PSU Employees

Two common mistakes are frequently seen:

- Staying only in “safe” instruments and missing long-term growth.

- Entering the market without understanding risk, volatility, or time horizon.

In the first case, inflation slowly reduces purchasing power.

In the second case, poor decisions can harm hard-earned savings.

The Right Approach: Balanced Investing

The correct solution is balanced investing.

Balanced investing means:

- Creating the right mix of safety and growth

- Balancing saving and investing

- Planning for both short-term and long-term needs

Taking calculated risk is important.

Keeping that risk under control is even more important.

A simple way to understand this:

Risk is like flying a kite —

wind is needed to rise,

but the string must always remain in your hands.

The Most Important Message

One key principle must always be remembered:

Ignoring growth completely in the name of zero risk

eventually becomes a major financial risk in the long run.

Risk should not be avoided.

It should be understood, planned, and managed.

The goal is not to escape risk, but to align it with your situation.

Final Thought

A PSU job provides a strong foundation and stability.

However, long-term financial strength depends on informed decisions.

Ask yourself:

- Is my investment approach suitable for my age?

- Does it match my income and responsibilities?

- Is it aligned with my financial goals?

When risk is chosen wisely, investing becomes calmer, clearer, and more effective.

👉 This article is specially created for PSU employees who want clarity, confidence, and long-term financial discipline.

👉 Join us for more practical financial guidance for PSU employees:

🔗 YouTube: https://youtube.com/@psupedia?si=HgkyHBAafuaYzVx8

🌐 Website: www.psupedia.com