Smart Tax Planning for PSU Employees – A Complete Guide

Tax planning is one of the most important steps in building a secure financial future for PSU employees.

With rising expenses, changing tax rules, and multiple investment options, planning wisely helps you save more money and reduce your tax burden legally.

This guide explains the most effective tax-saving tools available for PSU employees and how you can use them smartly.

🔹 1. Understand Your Income Tax Slab

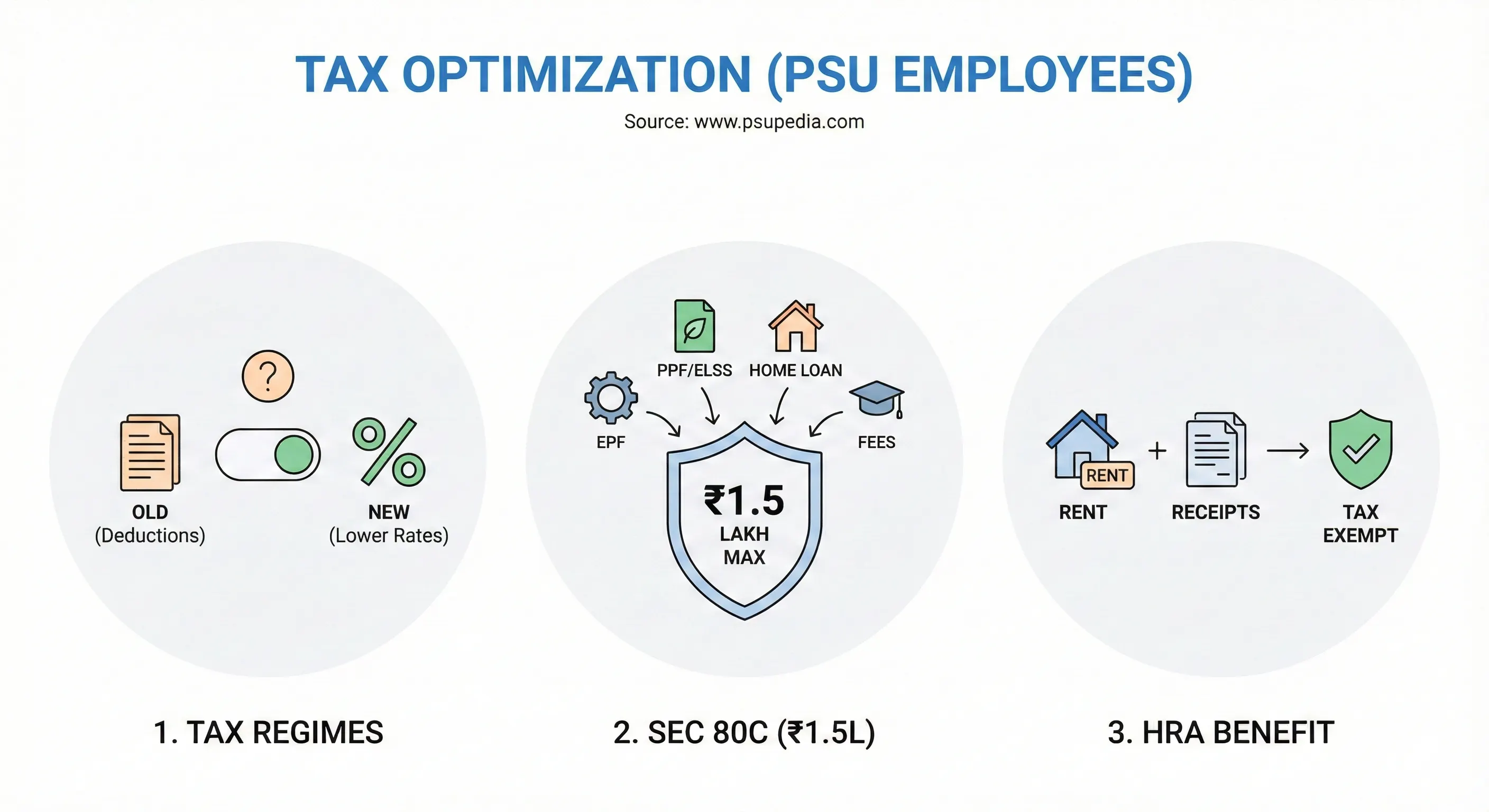

Tax planning begins with knowing your tax slab under the old or new regime.

- Old regime = More deductions

- New regime = Lower tax rates

Most PSU employees prefer the old tax regime because of the higher deduction benefits such as 80C, HRA, 80D, NPS etc.

🔹 2. Save Up to ₹1.5 Lakh with Section 80C

Section 80C is the most popular tax-saving tool.

You can claim up to ₹1.5 lakh using:

- EPF (automatically deducted for PSU employees)

- PPF

- ELSS (Equity Linked Savings Scheme)

- Life Insurance Premium

- Children’s Tuition Fees

- 5-Year Tax Saving FD

Tip: EPF + PPF + ELSS = Best balanced combination.

🔹 3. Use HRA (House Rent Allowance) Effectively

If you live on rent, HRA is one of the biggest tax-saving opportunities.

You can claim HRA based on:

- Basic Salary

- DA (Dearness Allowance)

- HRA Component

- Actual rent paid

This benefit is especially useful for metro cities where rent is higher.

🔹 4. Get Additional ₹50,000 Deduction Via NPS (80CCD(1B))

If you want extra tax saving beyond 80C, National Pension System (NPS) is the best option.

You get:

- ₹50,000 extra deduction under Section 80CCD(1B)

- Long-term retirement corpus

- Pension after retirement

This is one of the strongest tax-saving & retirement tools for PSU employees.

🔹 5. Reduce Tax Through Home Loan – Section 24

If you have taken a home loan:

- You can claim up to ₹2 lakh per year on interest paid (Section 24).

- Principal repayment goes into Section 80C.

This means PSU employees with home loans can save huge tax every year.

🔹 6. Use Section 80D for Health Insurance

Health insurance is mandatory today because medical costs are rising.

Tax benefits:

- Self + Family: Up to ₹25,000

- Parents (Senior): Additional ₹50,000

Even if PSU provides medical coverage, personal health insurance is still important.

⭐ Conclusion

Tax planning is not complicated — you just need the right strategy.

By using these sections properly:

✔ 80C

✔ HRA

✔ NPS (80CCD(1B))

✔ Home Loan (Section 24)

✔ Health Insurance (80D)

PSU employees can save lakhs in tax every year and secure a financially strong future.

🔗 For more useful tips and short educational

videos, visit:

📌 Join our Facebook Community for daily PSU education:

https://www.facebook.com/psupedia

Join our youtube channel for daily PSU updates: