Why Accident & Disability Insurance Is Essential for Every PSU Employee ( PSUPEDIA )

Accidents are unpredictable, and their financial impact can be devastating —

especially for PSU employees who carry major family and financial responsibilities.

Despite this, many working professionals neglect one of the most important protections available to them:

Accident & Disability Insurance.

In this detailed blog, we will understand why this coverage is essential, how it protects your income, and how one policy can prevent a financial crisis.

⭐ 1. The Hidden Risks Faced by PSU Employees

A PSU employee's work-life may appear stable, but the daily routine carries several hidden risks:

- Long-distance commuting

- Duty travel and outdoor assignments

- Shift-based work

- Operational and industrial environments

- High workload and irregular timing

These factors increase the probability of accidents — even minor ones — that can temporarily or permanently affect your ability to work.

This is why financial protection is not optional; it is necessary.

⭐ 2. What Actually Happens After an Accident?

When an accident occurs, three major financial problems appear immediately:

✔ 1. Loss of Income

If you are unable to work due to an injury, your salary may reduce or stop temporarily.

This directly impacts monthly expenses.

✔ 2. Rising Medical Expenses

Hospital visits, X-rays, MRIs, physiotherapy, and medications add up quickly.

✔ 3. Increased Family Pressure

Your responsibilities do not stop — school fees, EMIs, rent, groceries, and medical bills continue.

Without protection, your savings can start draining rapidly.

⭐ 3. Key Benefits of Accident & Disability Insurance

🔵 Benefit 1: Accidental Injury Cover

Even a small fracture can affect your work.

This policy provides financial support to help you recover without stress.

🔵 Benefit 2: Disability Cover (the most important benefit)

If an accident causes partial or permanent disability, your income can be affected for months or even years.

Accident Insurance provides:

- Monthly income replacement

- Financial support during recovery

- Long-term disability benefits

This ensures that your financial life remains stable.

🔵 Benefit 3: Accidental Death Benefit

In case of a severe accident, the policy provides a lump sum to your family.

This ensures:

- Children’s education continues

- EMIs remain manageable

- Household expenses stay on track

This benefit becomes a life-saving financial shield for your family.

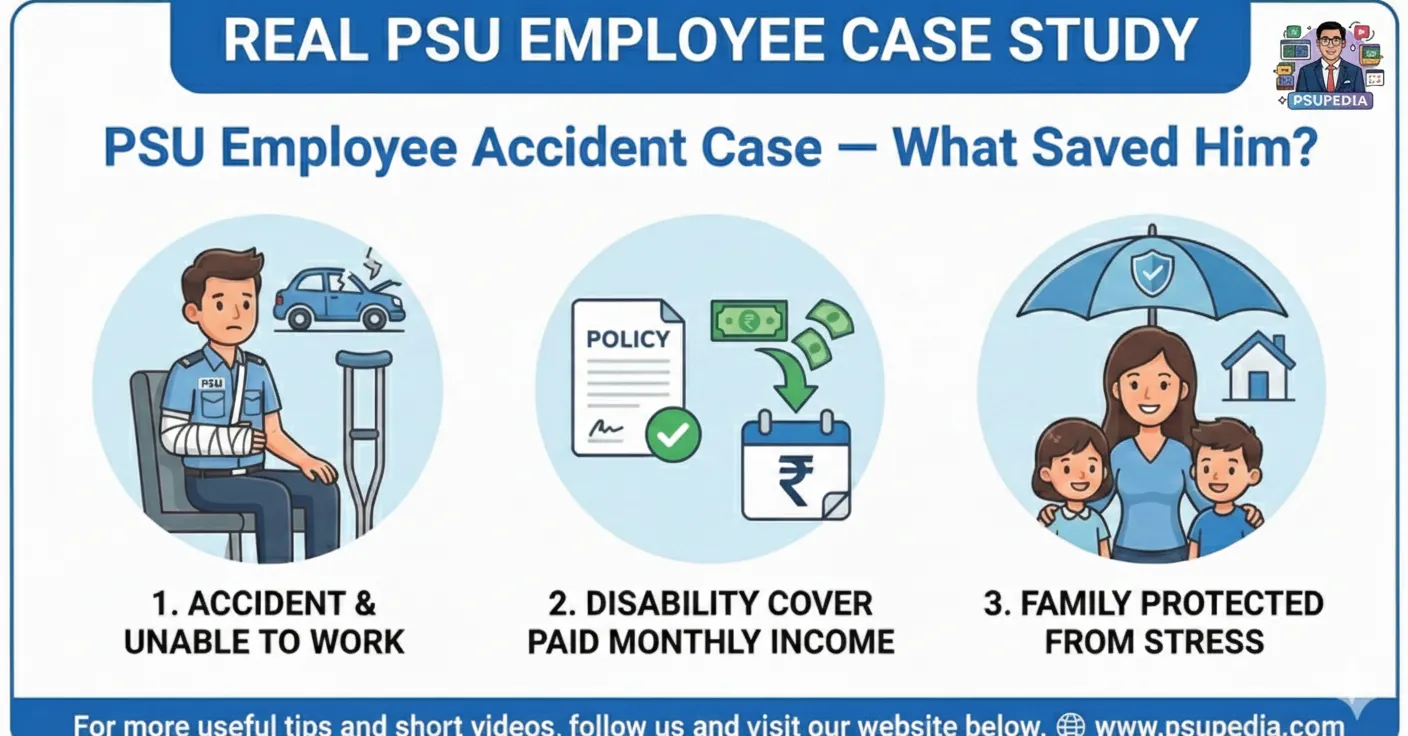

⭐ 4. Real Case Example: How One Policy Saved a PSU Employee

A PSU employee met with a road accident while returning home from duty.

He suffered a leg injury and was unable to work for four months.

This led to:

- Salary delays

- Increased expenses

- Emotional & financial stress

But because he had Accident & Disability Insurance, he received:

- Monthly income support

- Medical assistance

- Temporary disability benefit

- Complete family protection

One policy prevented a major financial breakdown.

⭐ 5. What Does Accident Insurance Cover?

Most people don’t fully understand the range of protection this policy offers.

Accident & Disability Insurance typically includes:

- Injury coverage

- Partial disability coverage

- Permanent disability coverage

- Monthly income replacement

- Hospitalization benefits

- Accidental death benefit

- Family protection

- Support during recovery treatments

This is not just insurance —

it is a complete financial protection system.

⭐ 6. Why Every PSU Employee Must Have This Policy

PSU employees manage essential financial responsibilities:

- Family expenses

- Rent / home loan EMI

- Children’s education

- Medical costs

- Long-term savings goals

One accident can stop your income suddenly…

but your expenses will never stop.

This policy ensures:

✔ Your income continues

✔ Your family remains secure

✔ Your savings stay protected

✔ You recover without financial stress

⭐ Conclusion

Accident & Disability Insurance is not an extra cost —

it is a financial seatbelt for you and your family.

Just like you never drive without a helmet or seatbelt,

you should never manage your financial life without this protection.

⭐ Join PSUPEDIA

For more financial education, guidance, and practical money solutions for PSU employees,

Join PSUPEDIA — Your trusted learning platform.

Join our youtube channel for daily PSU updates:

https://youtube.com/@psupedia?si=HgkyHBAafuaYzVx8