Why Every PSU Employee Should Understand NPS Before It’s Too Late

National Pension System (NPS) — Why It Should Be Part of Every PSU Employee’s Retirement Plan (PSUpedia Special)

Retirement planning isn’t just financial planning — it’s peace of mind. As a PSU employee with decades of service ahead, you want a system that’s secure, flexible, tax-efficient, and cost-effective.

That’s where the National Pension System (NPS) comes in.

In this PSUpedia article, we’ll explain what NPS is, what’s new, and why PSU employees should seriously consider it.

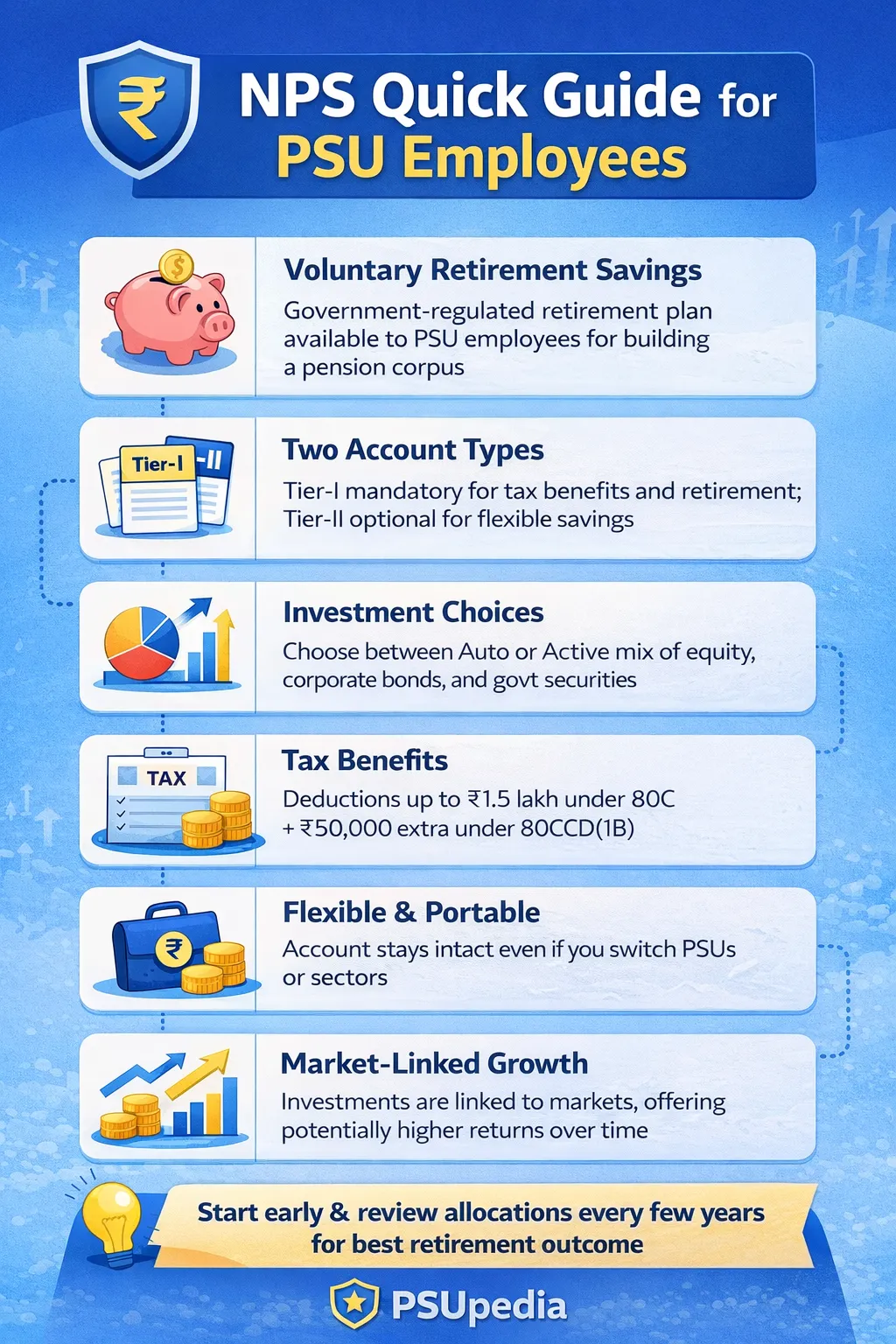

1. What Is NPS? (Quick Overview)

The National Pension System (NPS) is a government-regulated retirement savings plan designed to help you build a pension corpus during your working life — with a steady income in retirement. It is:

- Regulated by PFRDA (Pension Fund Regulatory and Development Authority).

- Voluntary & flexible for most employees.

- Open to all Indian citizens aged 18–70.

It’s different from traditional fixed deposits or PPF because your money is market-linked, meaning it can grow more — especially over long periods.

2. How NPS Works — Simple PSU Breakdown

Tier-I vs Tier-II Accounts

- Tier-I: Your main retirement account — contributions here are tax-beneficial and have withdrawal rules.

- Tier-II: An optional account for flexible savings without tax advantages.

As a PSU employee, most of your focus will be on Tier-I because that’s where retirement benefits and tax incentives are strongest.

3. Key Features PSU Employees Must Know

✅ Portable Across Jobs

Change departments? Get transferred? Move sector later in life? Your NPS account goes with you.

✅ Flexible Investment Choices

You can choose:

- Auto-choice — system automatically changes risk exposure based on age, or

- Active-choice — you decide how much to put in equity, bonds, government securities.

4. Recent Updates That Make NPS Even Better

(PFRDA has introduced important changes recently that improve NPS for working professionals.)

⭐ More Equity Choice = More Growth Potential

Now, in some schemes you can allocate up to 100% to equity, allowing long-term growth more like mutual funds — great for younger PSU employees.

⭐ Multi-Scheme Flexibility

Instead of sticking to one old option, you can now diversify into multiple schemes, tailoring risk and returns across your career.

⭐ Improved Withdrawal Options

While NPS is meant for retirement, new rules are making withdrawal at exit more flexible (e.g., reduced annuity requirement and systematic withdrawal plans).

⭐ Longer Contribution Window

You can now stay invested up to 85 years, letting your money grow longer if you choose.

5. Tax Benefits – Not Just Retirement Growth

NPS offers tax incentives that help you save today while securing money for tomorrow:

- Section 80CCD(1): Deduction up to ₹1.5 lakh within 80C.

- Section 80CCD(1B): Additional ₹50,000 deduction.

- Employer Contribution Deduction: In many PSU payroll policies, employer contributions may get extra tax advantage.

These benefits help reduce your taxable income while growing retirement savings.

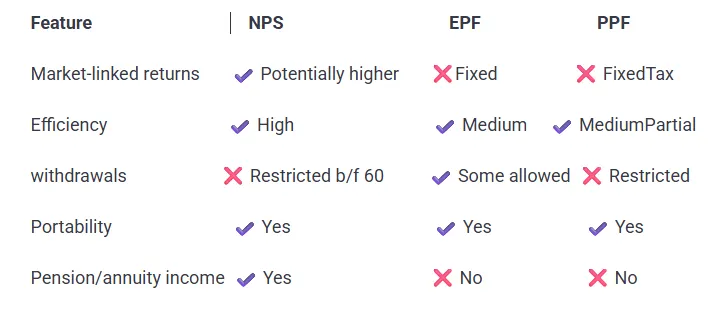

6. NPS vs Other Retirement Options (PSU Lens)

7. Common Mistakes PSU Employees Should Avoid

❌ Only choosing default options — explore investment choices based on age and risk.

❌ Ignoring tax benefits — many employees miss the extra ₹50,000 deduction each year.

❌ Not reviewing allocations — your investment strategy should evolve as you age.

8. PSUpedia’s Practical Take for PSU Employees

✔️ Start early, invest regularly: Compounding is your best friend — especially with equities.

✔️ Review choices every few years: Rebalance based on age, career stage, and goals.

✔️ Use Tier-II if needed: For flexibility without locking in retirement money.

✔️ Combine with EPF/PPF: To build a diversified retirement portfolio.

9. Quick Summary — Why NPS Matters for You

👉 Low-cost, transparent retirement plan regulated by the Government.

👉 Flexible investment choices with higher return potential.

👉 Portability across jobs and sectors.

👉 Tax benefits that can boost savings today.

👉 Updated rules bring even more flexibility and growth options.

And finally......

For more simple, practical, and trustworthy financial guidance for PSU employees, join us at PSU PEDIA.

🌐 Visit our website: www.psupedia.com

▶️ Subscribe to our YouTube channel & follow Facebook page for regular updates and easy explanations.

Keep Learning- Keep Growing.