Why Many PSU Employees Feel Financially Stressed Despite Stable Income

Regular salaries bring stability. But stability doesn’t always bring clarity.

In PSU life, financial stress rarely announces itself loudly.

There is no sudden crisis.

No missed salary.

No obvious breakdown.

Salary arrives on time.

Allowances are credited.

Bills are paid.

From the outside, everything looks settled.

And yet, many PSU employees carry a quiet discomfort about money.

When Stress Is Silent.

This kind of stress does not feel urgent.

It does not create panic.

It does not disrupt daily work.

Instead, it stays in the background.

A feeling of not being fully sure.

A sense that money is moving, but direction is unclear.

A habit of postponing clarity because nothing feels immediately wrong.

Silent stress survives because it is easy to live with.

Stability Can Hide Confusion.

PSU jobs offer something rare — predictability.

Income is regular.

Increments are expected.

Benefits are clearly defined.

Because of this, uncertainty feels manageable.

When income is stable, confusion does not feel dangerous.

It feels temporary.

Many employees think:

“I’m earning well.”

“I’m not struggling.”

“I’ll understand this properly later.”

Later feels safe when salary is secure.

Early Career: When Money Doesn’t Demand Attention.

In the early years of a PSU career, money feels simple.

Expenses are limited.

Responsibilities are fewer.

Decisions feel small and reversible.

Savings happen naturally.

Mistakes feel affordable.

At this stage, money does not demand awareness.

So it rarely receives it.

This is not negligence.

It is comfort.

Mid-Career: When Layers Appear.

As years pass, money becomes layered.

Family responsibilities increase.

Education costs enter quietly.

Medical needs appear unexpectedly.

Transfers disrupt routines.

Commitments overlap across cities and timelines.

Income continues to come in.

But understanding becomes harder.

Money starts feeling heavier —

not because it is insufficient,

but because it is unclear.

The Habit of Postponement.

Uncertainty creates delay.

Decisions are postponed.

Plans remain half-formed.

Questions stay unanswered.

Not because employees are careless —

but because clarity feels optional.

When nothing breaks immediately,

there is no pressure to pause and examine.

Over time, postponement becomes normal.

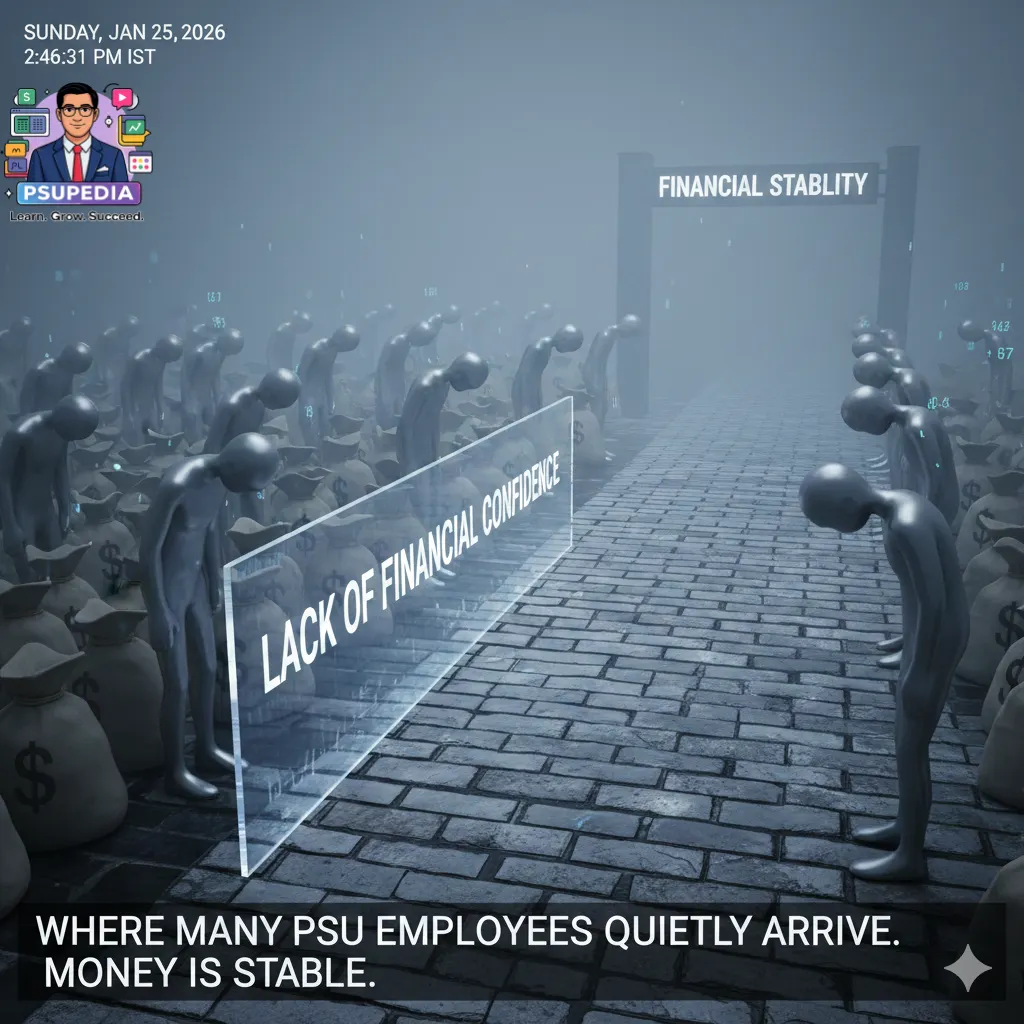

Financial Stability Without Financial Confidence.

This is where many PSU employees quietly arrive.

Money is stable.

But confidence is missing.

There is no clear sense of direction.

No strong feeling of control.

No calm certainty about whether things are truly aligned.

Work continues smoothly.

Life moves forward.

But peace remains incomplete.

The Emotional Cost of Unclear Money.

Silent financial stress does not shout.

It whispers.

It shows up as hesitation.

As second-guessing.

As mental load during otherwise normal days.

Decisions take longer.

Planning feels heavier.

Confidence feels lower than it should.

This stress is subtle — but persistent.

Why Awareness Comes Late.

Many PSU employees recognise this stress only after years.

When decisions feel heavier than before.

When experience increases, but confidence does not.

When money feels complicated instead of reassuring.

At that point, a quiet question arises:

“When did this start?”

The answer is rarely dramatic.

It started with delay.

With comfort.

With postponement.

What Personal Finance Awareness Really Means.

Personal Finance Awareness is often misunderstood.

It is not about earning more.

It is not about cutting expenses.

It is not about changing lifestyle.

It is about clarity.

Seeing one’s own money without fear.

Understanding flows without judgement.

Acknowledging gaps without pressure.

Awareness does not force action.

It removes silent stress.

A Shared PSU Experience.

This is not an individual issue.

Across departments, locations, and designations,

PSU employees share similar patterns.

High awareness of systems, procedures, and processes.

Low awareness of personal money systems.

This gap is not personal failure.

It is a system-conditioned blind spot.

Final Reflection.

Nothing is wrong with you.

If money still feels unclear despite stable income,

it does not mean something has gone wrong.

It means something was never fully examined.

Stable salaries can quietly carry confusion for years.Personal Finance Awareness begins.

not with change,

not with correction,

but with recognition.

A Note from the Founder.

I am Ramjee Meena, Founder of PSUPEDIA.

Over years of working closely with PSU employees,

I have seen how silent financial stress builds —

not because of poor income,

but because of delayed clarity.

PSUPEDIA exists to surface such realities calmly and honestly.

Not to judge.

Not to rush.

Only to help you see clearly.

Because clarity is not pressure.

It is relief.

Nothing is wrong with you.

You are just becoming more aware.